Understanding the Emerging Managed Office Market

As demand for sub 10,000sqft furnished offices rises, its time to understand how office management companies operate.

Avoid the voids, by changing your real estate strategy.

Flexible working will equate to c.20% of all commercial real estate occupancy by 2030.

Demand in flexible working has what seems to be an unstoppable momentum. This shift has also seen a rising demand for pre-fitted spaces, typically presented as CAT A+ or CAT B. However, to capture this new market demand, landlords can't just add kitchens and desks to bridge the gap from CAT A models.

The demand is intrinsically linked to overall amenity, management of services and the legal routes to occupy the space (licences/short form lease/management agreements & traditional leasing).

Understand Demand

In recent years the demand and size of requirement from occupiers of traditional flex space has shifted.. Typically an occupier (typically progressing from a serviced office), would be looking for anything from 1,000-3,000sqft of furnished workspaces. The demand was typically for short term arrangement from 1-3years.

However, transactions are now being regularly completed on spaces from 3,000-10,000sqft and for 3-5years. What hasn't changed is the requirement for flexibility and simplicity, over rate.

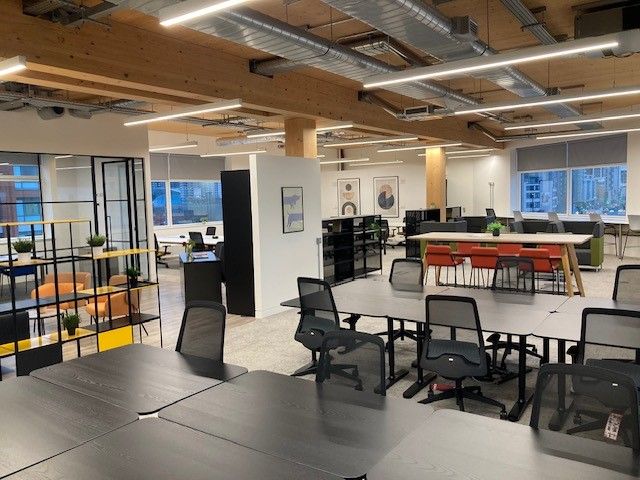

The most in-demand requirements today are typically between 2,500-5,000sqft. The offices rich in amenity (either shared or dedicated), a driving high demand and rate. Management companies skilled at delivering service led office spaces have been crucially intrinsically linked to the success of fitted managed office spaces.

Meeting Demand

The obvious route might be to partner with a flex management company. These emerging suppliers are filling the widening gap between serviced offices and traditional leases. They are skilled at delivering service lead office solutions, to occupiers wanting a simple office model, at scale but aren't ready to take a lease.

A management company will assess your space(s) and suggest what needs to be improved (fitout, amenity, utility etc.) to capture the emerging demand.

Typically, there would be an investment case to consider, which will balance investment vs return. Its commonly accepted that a lease will only yield income from 8 out 10 years on a lease. A flex model could reduce the void period by 1 year, so its essential to understand the commercial mechanics before investing.

Understanding the legal framework.

The most common method is to lease your space to a management company. They will want expressed terms to 'sub let' by way of a licence agreement, back to their client. The sole purpose of the lease will enable them to licence back the office space and manage the clients services for a management fee. The Alienation clause will set out this right and terms around the clients covenant.

By partnering landlords can expect to see a reduced void period, higher rent returns &SC returns plus mitigating business rates exposure.

Landlord - Receive Rent & SC payments as normal. If they've agreed to furnish the space first, then they can potentially expect increased rental contributions, in order to return initial CAPEX investment improvements.

The management company - They will deal with BR, utilities, services, maintenance and any other requirements their client demands. The licence agreement or short-form lease will cover their costs in the management fee.

Other management companies might ask the client to sign the lease directly with the landlord and an addendum will be created in the lease, referencing the management companies contracted services. The appended document will reference the management companies obligations to the client and their fee's.

Conclusion; The traditional CAT A office unit is struggling to compete against its furnished, managed and amenity rich competitors.

The traditional sub 10,000sqft office world is changing, will you be ready to meet it head on?